Because of my previous post, I discovered a book called ‘The Art of Strategy’ by Dixit and Nalebuff. I had read their first book called ‘Thinking Strategically’ published in 1993. Its focus is game theory applications in business discussing bargaining, unconditional moves, and vicious circles. It is fairly focused on dealing with opponents, which was – like Sun Tzu – quite popular at the time. When I wrote my first Novel ‘Deity’ in 2003, game theory was an intriguing subject that played a big part for a quantum computer who could not only predict, but influence the future. Game theory uses mathematical models to analyze decision-making for strategy, in which one individual’s decisions are based on the assumptions what the actions of other actors might be. When each player has adopted a strategy to play, an equilibrium can be reached. But that was only the beginning.

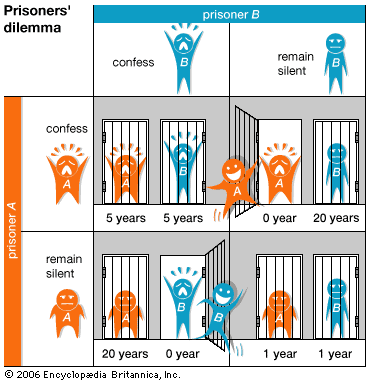

The Beginning: 'The Prisoners Dilemma Game'

The great minds of game theory are John von Neumann, Oskar Morgenstern and clearly John Nash for non-cooperative games. Most game theories are based on the idea of utility, meaning a rational, measurable benefit that one player can gain by acting a certain way. Game theory assumes that humans actors use similar abstract concepts in the sense of epistomology (what can be known) for their decision-making and for deciding upon actions. Not only the knowledge of the players is different, but most likely also their concepts of knowledge can be quite different. Our rationality needs however a model of reality to understand the means to act in a desired manner. It is in fact impossible for the decision-maker to know the complete state space and consequently all the possible actions by other players are not reasonably predictable as possibilities. It is therefore not surprising that behavorial economics discovered that most human decision-making is not based on rational utility. Some does even seem rather irrational, when it really isn’t, but uses heuristics such as bounded rationality (Gigerenzer et.al.) to decide under uncertainty. Evolutionary game theory assumes therefore no rationality or bounded rationality for its players and considers both biological and cultural evolution as well as individual learning.

Game Theory is thus still in development and only in 2007 Myerson, Hurwicz, and Maskin were awarded the Nobel Prize in Economics for their work in reverse game theory or mechanism design. They worked on game types where the rules of a game are actually designed while it is being played, with the designer having an interest to influence it’s outcome. Those concepts deal much more realistically with the real world of human-made rules and laws. It does have a strong similarity to the concepts of Adaptive Processes. One of the key elements is the necessity to extract information from the players that they would rather not divulge. The need to gather dependable decision-making information from uncooperative agents is a real business management problem.

I find these theories truly interesting in terms of mathematics, but with little practical application, mostly because of the mentioned epistomological modeling problem. All theoretical results are built on well-defined and controlled models that do not translate to the real world. The findings indicate however that the human mind can be dreadfully misled by thinking that these model concepts are real. In for example contract theory, a decision maker applies an optimization algorithm to achieve a ‘complete’ contract. He attempts to motivate players to take desired actions as maximizers of von Neumann-Morgenstern utility functions. Expected utility decision-making ASSUMES however the probability of various outcomes, thus the expected value of decisions is extremely sensitive to the assumptions, particularly with rare extreme events, a.k.a. as Black Swans. Enter the recent financial crisis!

Applying game theory for business strategy or management thus faces many obstacles, because doing business is in most cases not like a sequential or simultaneous game but an unknown mix of both with an unknown set of players under substantial uncertainty. Each real-world actor has a long tree list of dependent decisions to take that ought to be looked forward and reasoned backward in theory. Because the knowledge and possible actions of other players are mostly based on pure assumptions, it is a good strategy to retain the ability to change course en-route or allow for the renegotiation of agreements. Only in a few cases is reducing your options beneficial as an undoubtable signal, such as Cortés did in 1519 by scuttling his ships at Veracruz. He was intent to make his signals believable, because he also massacred thousands of the Aztec nobility to convince emperor Montezuma to capitulate.

What can we then learn for business from the study of game theory?

To burn your bridges or threaten your employees? I guess not. Yes, it is important that executives and managers send clear signals that are trustworthy. There is no difference, as asserted repeatedly by Dixit and Nalebuff, between employee and children behavior. “Either do this or else …” has to be followed by actions that assert the consequences. I see however the aspects of information exchange and information congruency for decision-making as the most important elements. The problem of ‘what we can know’ must be taken care of in business by creating a common information model for all players inside the business. Not a data model for programmers, but an information model for business people. Finally, empowerment ought to be used to motivate all players to act transparently and fill the model with realistic data. The “… or else …” is what I call boundary rules as an essential element of empowerment.

Bain & Company found in studies that 70% of all reorganizations do not improve anything and some actually worsen the state of the business. Next to a lack of accurate information, the core reason is that decision-making is not aligned with authority given. As only a few substantial changes can be executed at one time, change should not happen in Big-Bangs but continuously from the bottom-up by empowered employees. Also Forrester Research recently published a book focused on the subject, aptly named “Empowered.”

‘The Art of Strategy’ left me however dissatisfied, I guess because it retraces much of the original book with different examples and stories about threats, challenges and promises. While the book deals with strategically anticipating your opponent’s moves, it employs simple, counterintuitive common sense. Concepts like ‘put yourself in the opponents shoes’ and ‘actions speak louder than words’ are commonly accepted perspectives that I would not consider a scientific sensation. Also ‘countersignaling’ is not a new idea, explaining that those who belong don’t need to signal (=brag), while someone who i.e. lacks scientific credentials enforces the use of his PhD title. I have often said that the most prominent feature in ads is most likely the weakest aspect of a product. But competing by louder and more ads isn’t always the best approach. When cigarette TV advertizing was banned, tobacco companies fought it as they thought it would hurt them, but in fact because all companies suddenly did not have to compete through TV ads it substantially raised tobacco profits.

In conclusion it seems that most successful strategies are random chance and not achieved by applying a ‘complex systems thinking’ approach that tries to model all the complex dependencies of actions and reactions of all players in advance. Gut feelings and ‘guts to act’ are clearly more important than strategic models of business games, according to Gigerenzer. What remains for a business to improve is the need for real-time transparency to improve decision-making and for empowerment to translate the decisions into action. The business hierarchy is not about command and control but about proper role play in the business game. The executive needs to set strategic objectives, that are translated into targets by management, linked to goals by process owners, and executed as tasks by people skills to fulfill the customer outcome. Yes, doing business can be seen as a game, but it won’t be improved by theories and methodologies, but by empowering people with information technology and the means to fulfill the goals.

While a fool with a tool remains a fool, trying to execute a great strategy without the best in tools is plain dumb. A fool that needs a methodology to manage is outright dangerous. A wise general will create a strategy based on weapons technology available on both sides, because not to do so is gross negligence or even murder.

What can we take away from all this? Well, the concepts of information exchange in Game Theory support the importance of IT for running a business. The executive who designs a business strategy without understanding what information technology can provide and how the competition uses it, is endangering the future of his business.

Therefore, strategy has to follow real-world technology and not some theory.